The financial institution preserves currency once you deposit a during your cell phone. And usually, your own financial won’t charge you for making use of this specific service. We wear’t learn about your, nevertheless the very last thing I do want to manage after a long week try attend a lender line to have 20 or 29 minutes. To the a friday afternoon, all you need is to go back home and enjoy the sunday. In case they’s payday and your company doesn’t give head deposit, you’ll need to make a visit to the lending company. Myself, this has been in the a-year since i have’ve accomplished a financial purchase in the lobby.

Put costs | online mahjong 88 games for real money

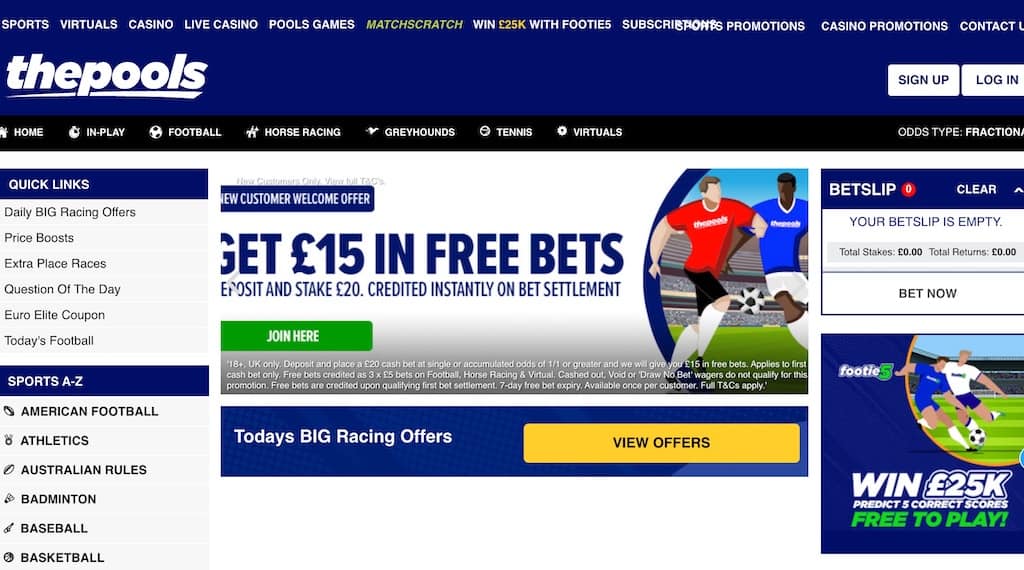

Cellular look at deposits may be refused due to mismatches between the check’s guidance and you can member-considering information, such as incorrect number or unreadable signatures. Yes, shell out because of the portable equipment gambling enterprises is certainly court in the United Empire as it’s regulated from the Uk Betting Payment. To make money from the telephone is simply various other form of shell out utilizing your telephone.

Cellular deposit

When it happens you should cut off it together with your service provider and you will if online mahjong 88 games for real money possible, tell your online casino to stop people dumps unless you come across they or and get an alternative smartphone. Swift Local casino existence around its term as the a speedy cellular deposit gambling enterprise you to definitely sets players to the step quickly. Partnering that have major cellular commission team so you can power your own deposit, Quick Gambling establishment techniques these deals instantaneously and fees them to your cellular telephone costs.

Technical troubles, for example, will make it impossible to make use of mobile take a look at deposit software in the event the indeed there’s a problem. And not be able to have fun with mobile look at put should your view you will want to put are above the limitation invited by the financial. If you believe cellular consider deposit was a valuable financial function, there are several points to consider while using they. Accurately endorsing a to have mobile deposit decrease the chance of your own deposit’s getting declined. You’ll should pursue this type of laws and regulations if or not your’re preparing a personal consider, a certified take a look at or a cellular deposit cashier’s take a look at.

- Check out the Pursue Car Degree Cardiovascular system to locate automobile information out of a trusted supply.

- You might link your eligible examining or savings account to help you an enthusiastic membership you have during the various other lender.

- As soon as your mobile consider put clears, you can enjoy the funds in your membership.

- For those who don’t has a deposit sneak, you can just generate your bank account matter to your take a look at.

- Alyssa Andreadis is an author with more than twenty five years out of sales feel which can be passionate about helping family be comfortable with currency.

- Inside the now’s electronic ages, placing monitors was more convenient than in the past, because of the improvement mobile financial technologies.

But not, note that particular providers including Meters-Pesa enable it to be pages to cover its accounts thru ATMs, representatives or that have coupons. I encourage agents with cutting-border security features including a couple-grounds verification and you will biometric ID, in addition to strong privacy procedures including SSL encryption. Just be in a position to believe in the new broker your’re also mobile your bank account in order to, so trust are all of our consideration whenever we price trading systems and it also is going to be yours, too.

Handmade cards

Anticipate to give them away with your ID, debit cards, deposit sneak, and you may endorsed look at. Let the teller know the way much you need to put and you may if or not you would like any money back. No, the new gaming website won’t charge a fee for buying to make dumps playing with pay by cellular harbors. The fresh casino is not in control if your telephone provider charge a negligible amount. If the app implies difficulty, you’ll should glance at the processes once again. It’s best if you store they for some from weeks, and in case something needs to be verified.

Our lovers usually do not shell out us to make certain advantageous recommendations of the goods and services. Morgan Riches Administration Part or here are some the newest on line investing provides. Just as with a timeless put, there’s usually the possibility you to definitely a check get jump. So that the finance are transmitted precisely, it’s smart to hold onto your inspections before deposit have removed. This way, you’ve got the check into turn in instance some thing fails during those times. Rebecca Lake is actually an official instructor inside the private money (CEPF) and you will a banking specialist.

Be sure to produce ‘mobile view deposit’ and the time to the front side of the view, and you will help save they to own 3 months. Promoting a check and making a cellular take a look at deposit is actually seemingly basic steps. Mobile banking programs improve procedure easier which have step-by-action recommendations and you will suggestions when you take photographs of the take a look at. Simply pursue the financial’s instructions making a profitable deposit. As soon as your mobile view deposit clears, you may enjoy the amount of money on your own account. Wells Fargo imposes daily and you can month-to-month limits on the complete money number of view deposits you possibly can make via cellular deposit.

The bank’s mobile view deposit arrangement often outline the sorts of checks you happen to be allowed to deposit. Consult your provider for specifics of particular costs and costs. For those who found a blunder content, take some time to make certain your’ve recommended the brand new consider, finalized your name, and affirmed the brand new put number and you may account information. If the put demand nonetheless doesn’t experience, you may also imagine contacting your financial business for guidance.

If you would like to speed up the income deposits, you may choose to take advantage of head deposit. This allows your boss to deposit money into their financial account instead providing you with a newsprint view. To set up an immediate deposit, it is possible to essentially need to pose a question to your workplace for a direct put form, done they together with your account information, and you will fill out the fresh completed mode back into your employer.

You’ll capture photos of the view inside application and you will go into consider information, for instance the number, doing your put. Banking companies generally inform you during your picked method (email address, text, force notification) that the cellular view put is actually processing. They are going to along with usually notify you if the view has been processed. Mobile financial institutions discover defense against the brand new FDIC to safeguard the dumps. Just be sure you utilize basic sites protection strategies to protect your own passwords and you will analysis. That have a cellular banking software, can help you all those employment at any place, greatly simplifying the whole process of handling your money.

Just after signing to your bank’s mobile app, pages can be discover mobile deposit option, capture an obvious photograph of the back and front of one’s consider, enter the amount, and you can fill in the fresh put. The newest app always brings quick confirmation, and the fund are offered inside a business time. The fresh mobile consider put techniques makes you fill out your own inspections playing with a supplement or smartphone whenever, almost anyplace.

Placing monitors making use of your mobile device can be far more accessible and you can less time-sipping than just operating to help you a part or Automatic teller machine. And in case you financial which have an on-line-simply bank and no bodily twigs, cellular view deposit could be shorter than just emailing inside the a check. If your lender plans to set a hold on tight the brand new put, you could discovered a notice before signing a cellular consider deposit. You’d then have the choice to continue to the mobile put or take the fresh view to a branch rather.